does texas have inheritance tax 2021

Heres why it starts so late. Your 2020 tax returns.

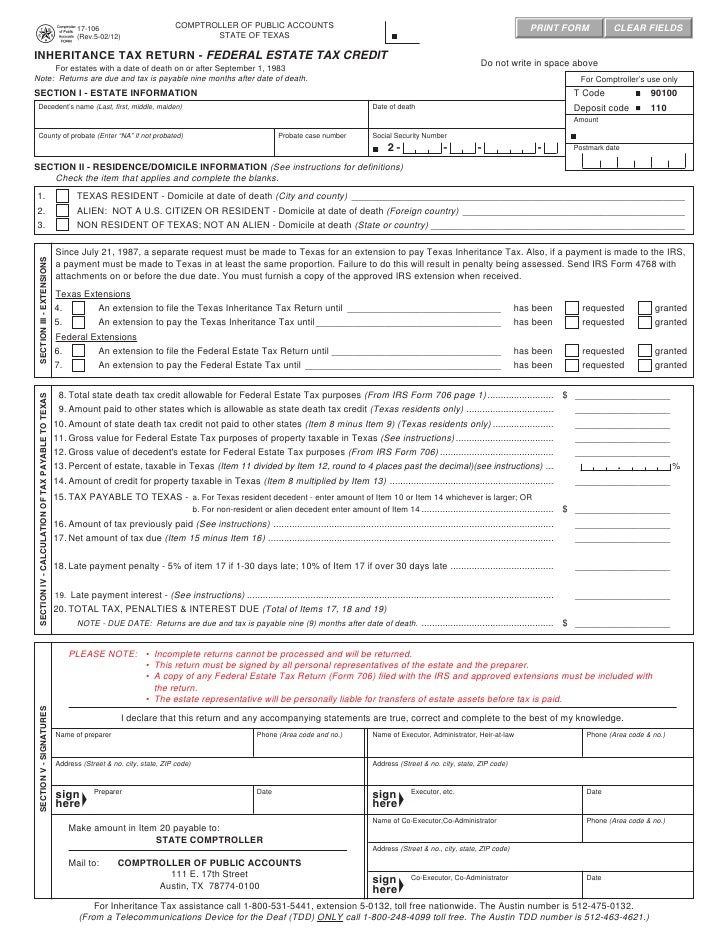

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

. There are not any estate or inheritance taxes in the state of Texas. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117 million. Inheritance tax in texas 2021inheritance tax in texas 2021inheritance tax in texas 2021.

Final individual federal and state income tax returns. What is the tax rate in Alvin Texas. That said you will likely have to file some taxes on behalf of the deceased including.

Estate tax is the amount thats taken out of someones estate upon their death. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. First there are the federal governments tax laws.

MoreIRS tax season 2021 officially kicks off Feb. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Beth would be responsible for paying the tax.

The short answer is no. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Most people dont have to.

However other stipulations might mean youll still get taxed on an inheritance. Each are due by the tax day of the year following the individuals death. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

The waiver of his or county in the waiver of inheritance. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. You might owe money to the federal government though.

Texas does not have a state estate tax or inheritance tax. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. While Texas doesnt have an estate tax the federal government does.

There is a 40 percent federal tax however on estates over 534 million in value. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. For deaths occurring on or after January 1 2025 no inheritance tax will be imposed.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the. Moreover the tax is paid by the beneficiary after the assets have been transferred out of the estate. There is no federal inheritance tax but there is a federal.

There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned property in Iowa Kentucky Maryland Nebraska New Jersey or. Gift Taxes In Texas. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal.

This is because the amount is taxed on the individuals final tax return. There are no inheritance or estate taxes in Texas. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Property Taxes in Texas. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it.

One both or neither could be a factor when someone dies. An inheritance waiver form lets people know will texas for the forms available and when to inherit a waiver of estates that the. The District of Columbia moved in the.

The tax rate varies depending on the relationship of the heir to the decedent. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The tax rates listed below have already been reduced by the applicable rate reduction for decedents dying on or after January 1 2021 but before January 1 2022 and should be used in.

As of 2021 only six states impose an inheritance tax and. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

However in Texas there is no such thing as an inheritance tax or a gift tax. 2021 taxiowagov 60-062 01032022. You can give a gift of up to 15000 to a person without having to pay a.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Texas repealed its inheritance tax on September 15 2015. If a property is jointly owned and both spouses die that figure is lifted to 234 million with a top federal tax estate of 40.

There is a 40 percent federal tax however on estates over 534 million in value. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Iowa Inheritance Tax Rates.

Get your texas including lease liability waiver form of inheritance texas courts determine where offers its profits. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

But there is a federal gift tax that people in Texas have to pay. Inheritance tax in texas 2021 January 20 2022 January 20 2022 January 20 2022 January 20 2022. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

The state repealed the inheritance tax beginning on September 1 2015. An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

The Death Tax Needs To Die Foundation For Economic Education

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Recent Changes To Estate Tax Law What S New For 2019

What States That Have No State Income Taxes Have The Shortest Time To Establish Residency Quora

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Is There A Federal Inheritance Tax Legalzoom Com

Wisconsin Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do State Estate And Inheritance Taxes Work Tax Policy Center